Yesterday’s announcement from Bank of Canada to reduce policy rates to 4.75% signals relief for many across the country, as interest rates have risen dramatically since 2022 and held at the 5% policy rate since July of last year.

A reduction in rates should help ease carrying costs and stimulate moderate lending activity across industries. While inflation has cooled significantly in recent quarters, demand for goods and services driven by record population growth continues to be a challenge for the Bank of Canada. The US Federal Reserve is poised to announce their monetary policy update on June 12. Canada’s economic ties south have markets waiting on this next signal to assess whether or not the latest rate cut is the start of a trend.

The industry is holding position

Major markets across the country appear to be in a holding pattern as lenders, developers, and owners continue to adapt to changing market conditions. Fuel prices remain volatile, and construction material costs remain inflated far beyond pre-COVID pricing.

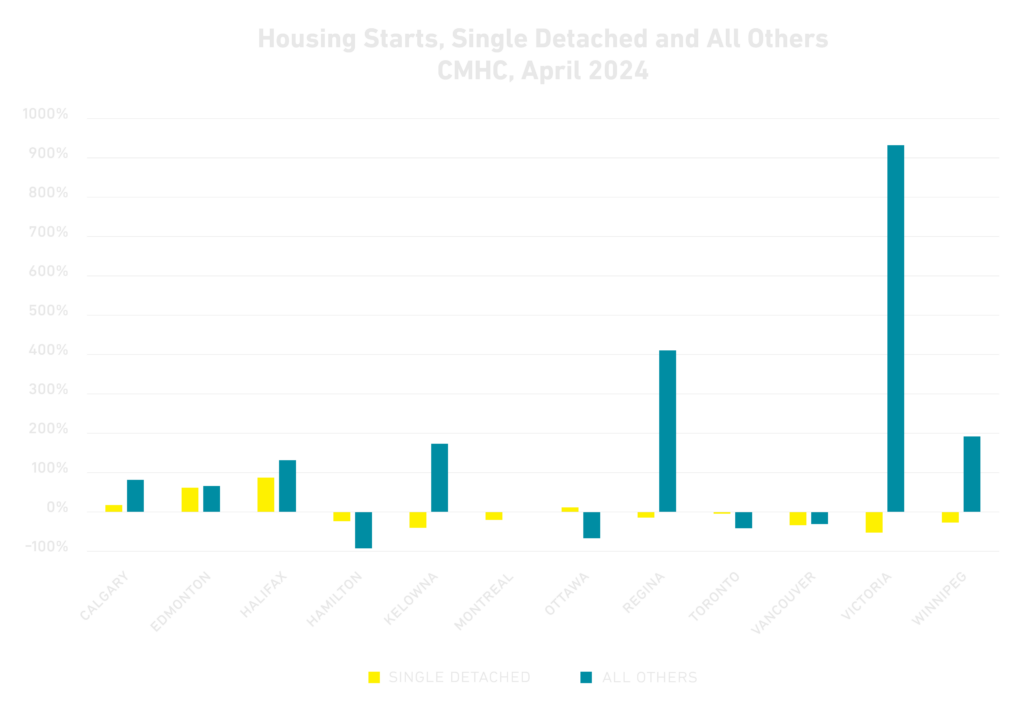

Ontario has experienced a significant shift in housing starts recently. When compared to April 2023, April 2024 saw a 37% decline in housing starts, with major drops in Toronto (-38%), Ottawa (-58%), and Hamilton (-91%). Toronto’s condominium market has experienced rapid deceleration as a glut of supply and lower interest from buyers has slowed down sales pace considerably. Many developers have placed new offerings on hold while existing projects maintain progress to completion, further adding supply to the market.

The Prairies continue to see considerable population growth, both from immigration and inter-provincial migration. This has led to big increases in housing starts overall, which have climbed 67%, with significant gains in Calgary (+57%), Red Deer (+163%), Edmonton (+64%), Regina (+260%), and Winnipeg (+94%).

In British Columbia, affordability continues to contrast with population growth, as the Greater Vancouver Area saw a drop of 30% overall, while areas like Victoria (+456%), Nanaimo (+626%), and Kelowna (+76%) saw substantial gains. In BC, municipalities are also tasked with improving affordable housing supply by the Ministry of Housing. Announced in September 2023, the plan calls for 60,000 new homes to be delivered by 2028, with over 16,000 below-market rental units. $10 million was also earmarked to expedite the Development Approvals Process as complex permitting and compliance processes have been cited as a significant challenge by developers.

Complex market conditions make for a hazy second half of 2024

Demand for housing as well as skilled labour availability is coupled with material and labour pricing volatility and continued record population growth. These factors all contribute significantly towards Canada’s short- and long-term economic future.

Although deceleration of activity in housing starts across several major metropolitan sectors has been observed recently, the construction industry continues to be a leader in Canada’s GDP. The sector’s resiliency remains a critical driver of growth. As the population grows, the industry will play a crucial role in satisfying rising demand for both housing and infrastructure across all provinces and territories.

The Bank of Canada’s announcement may signal the beginning of a shift away from Quantitative Tightening; lower cost of borrowing can stimulate investment and project development, especially if additional reductions to the Overnight Rate are anticipated and occur during the remainder of the year.